Red Jacket Theory

Red Jacket was created in 2011. Back then, we helped create and manage of one of the first currency and commodity funds based on artificial intelligence and machine learning. Working with Dr. Andrew Wong, founder of the Pattern Analysis and Machine Intelligence Lab at the University of Waterloo, we launched the KFL Partners' Fund. It represented the pure “science” of trading. In 2014, we won CTA Newcomer of the Year at the annual hedge fund awards ceremony in New York City.

We have been immersed in the “art” of trading as well. From 2012 to 2017, we traded proprietarily over $10 billon of currency pairs with our friends at the BMO FX desk in Toronto, Chicago and London. We have always loved this asset class for our own accounts but it is complex, requires huge leverage/risk of large losses, and constant monitoring. Consequently, it was tough to bring to clients; until we found Gemini shares and Theta King contracts, these challenges of FX trading were reduced.

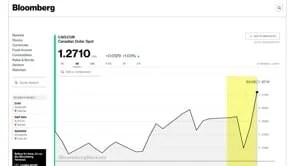

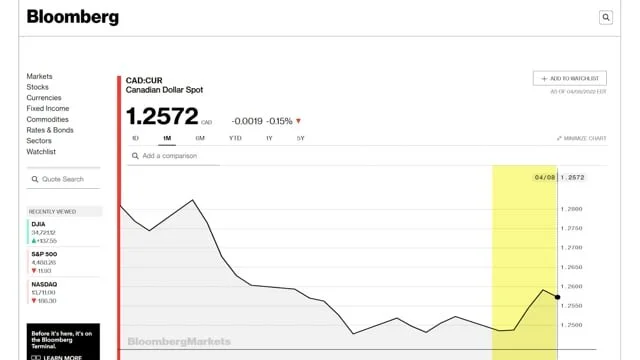

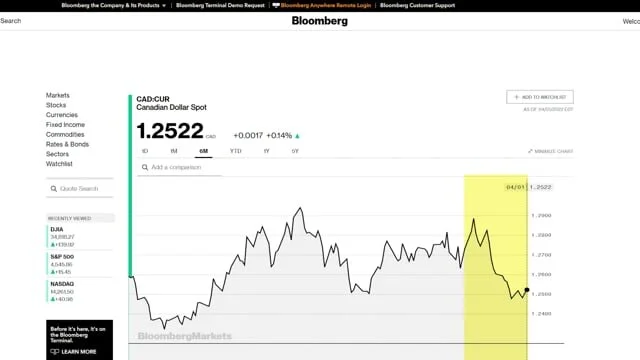

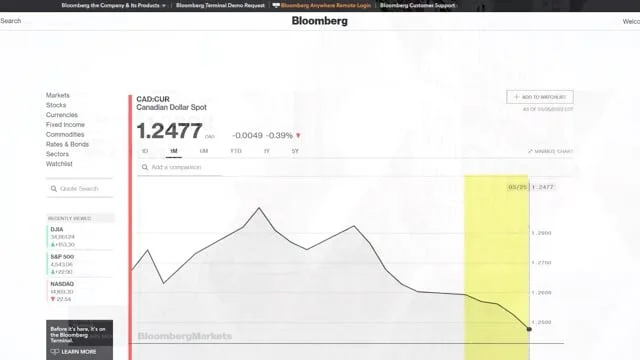

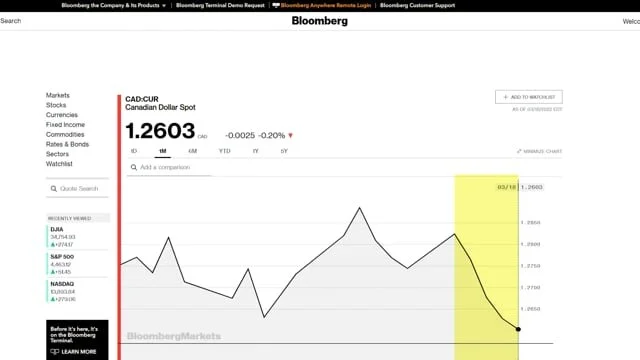

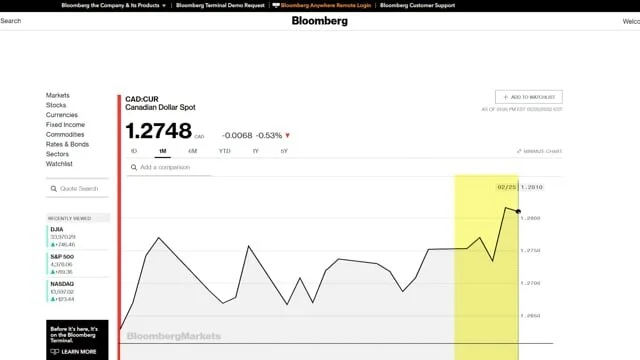

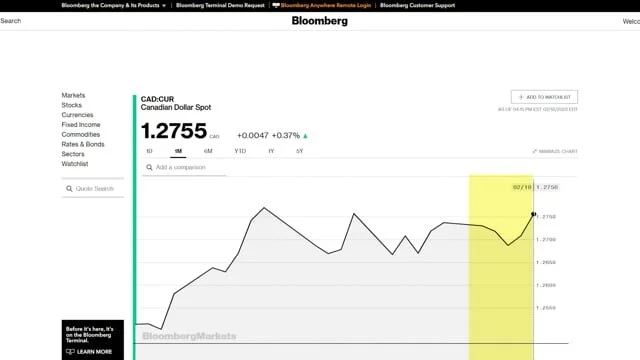

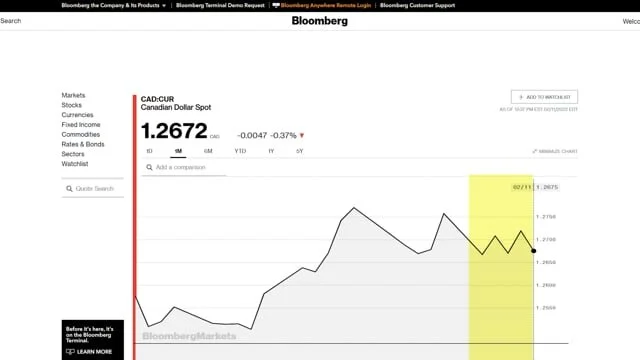

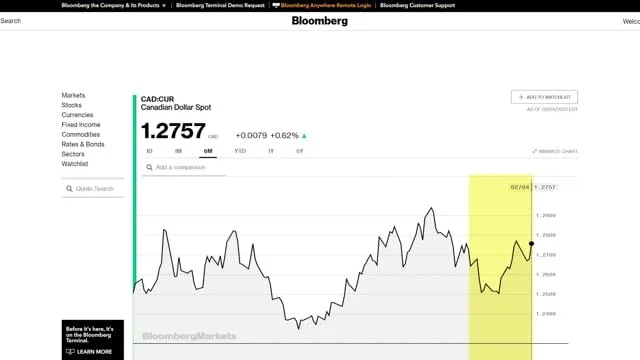

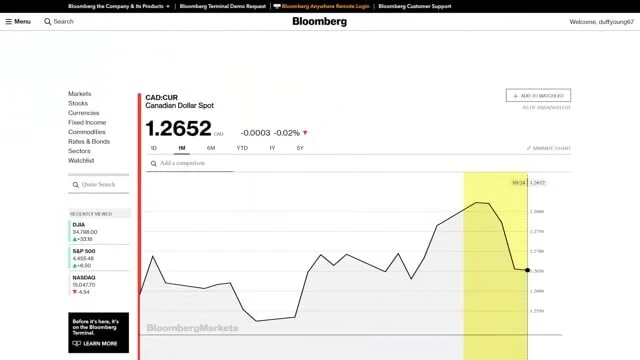

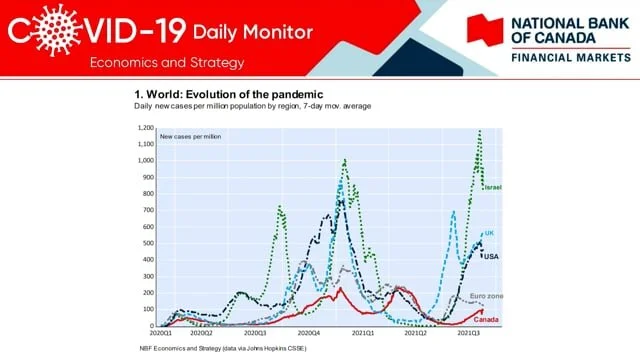

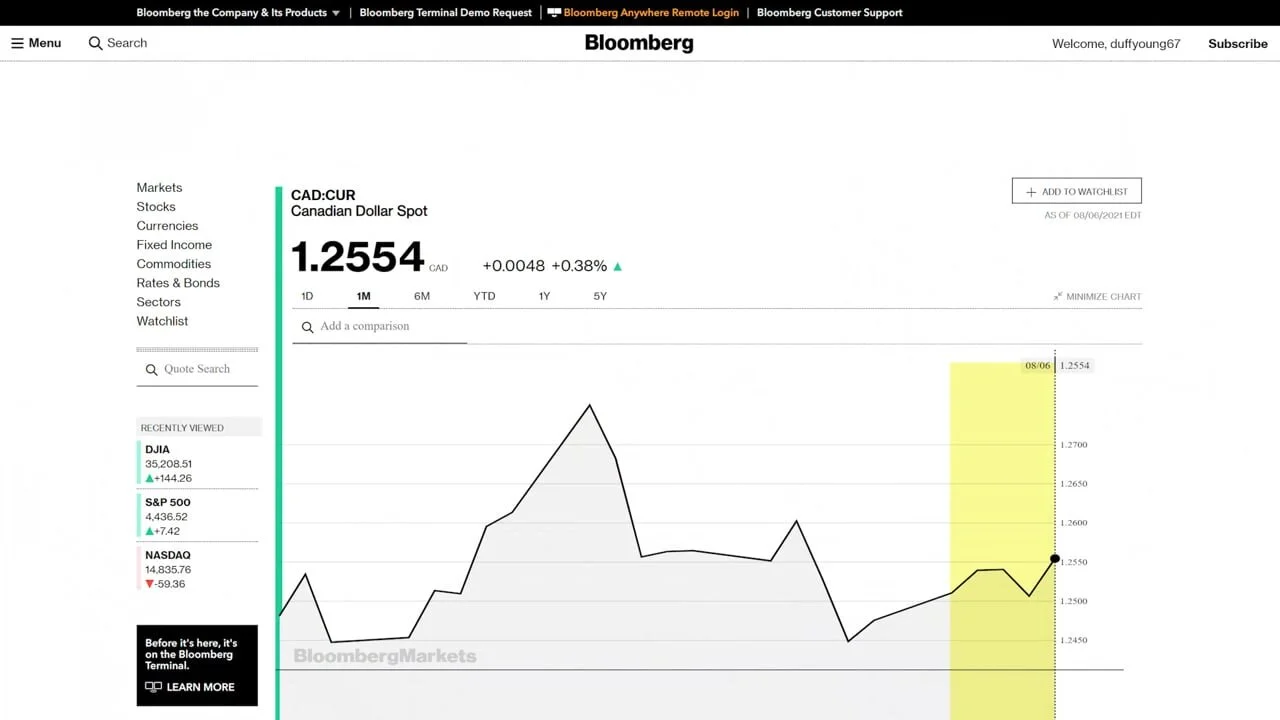

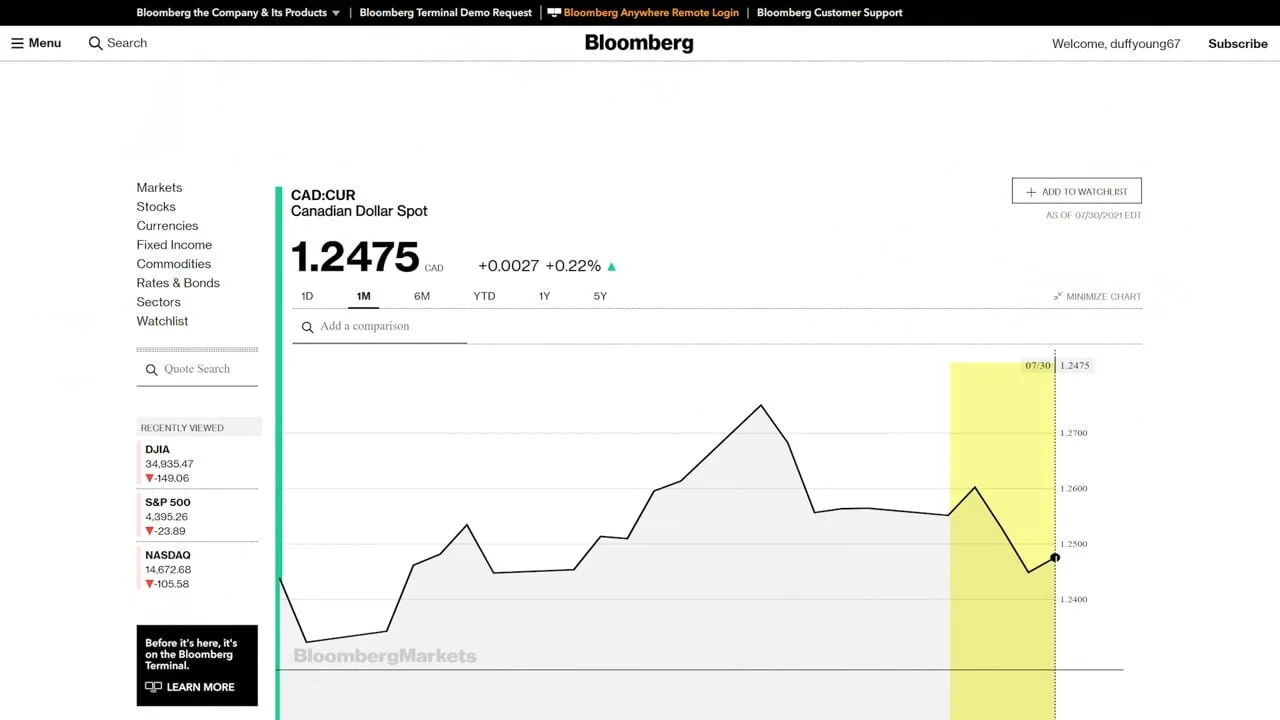

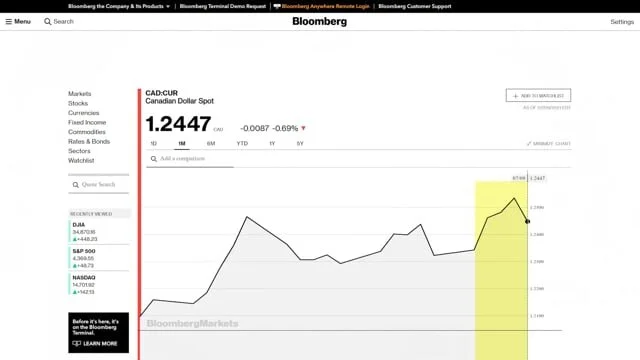

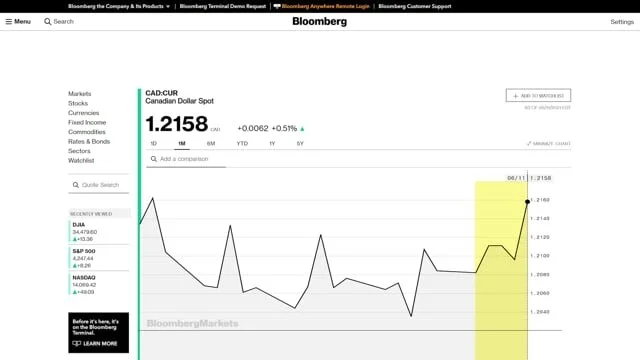

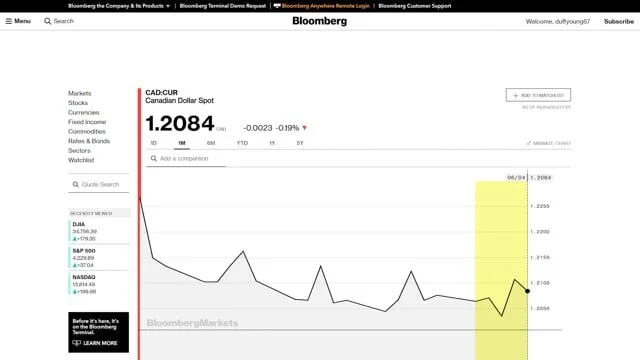

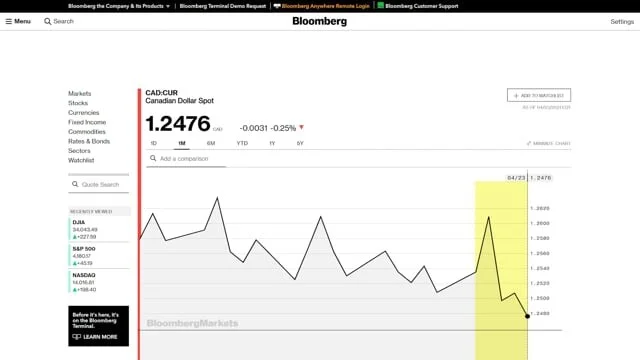

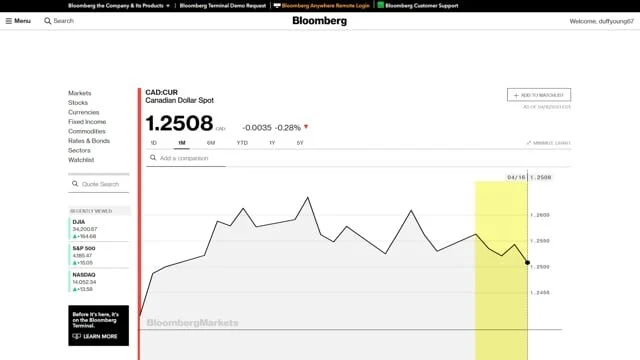

While the Gemini shares and Theta King contracts elegantly solve the problems of complexity, leverage, and monitoring, clients are still left with the most basic question to answer; What is going to happen in the next week or month in the USDCAD?

To help answer that we have merged the KFL experience with the art of trading. We were encouraged to do this by World Champion chess player Gary Kasparov whom we met a couple of years ago. We asked him what he thought about the future of machines. He told us about the famous moment when he realized Big Blue, the IBM computer was going to beat him (Turn 44 as it is called). At that point, he thought machines would win.

Gary's tune has changed. The best way to beat machines, he says now, is to join them. Man and machine will win every time.

So, we believe, the answer to the question of where the USDCAD is headed is best found when you combine art and science. That’s why we offer you help in both ways.

Nick Howell

Chief Strategist

Each week, our Chief Strategist, Nick Howell, provides the qualitative analysis of the USDCAD and shares his general ideas about positioning both in terms of outright direction (long/short) and volatility. Nick spent over 20 years on BMO’s FX desk where he traded more USDCAD than anyone on the planet. That experience gives him insight into what really drives the market for Canadian and US dollars. In our terms above, Nick is an artist. Each Sunday night we send out an audio clip of Nick’s insights, recent installments of which are below. The Red Jacket positions for Theta King and Gemini are informed, in part, by Nick’s commentaries. We also use the two systematic, scientific models described below to inform our recommendations.

“Jeremy”

Theta King Model (30 day predictions)

A systematic model that uses data (the delta between the volatility of puts and calls) to predict the next 30 days of price movement for the Theta King investors. We run this model the morning of each trade and provide a prediction of which contract (“Up” or “Down”) is likely to mature in the money. Pure science.

“Jeronimo”

Gemini Model (one week predictions)

More science. This model makes weekly predictions based on deep learning algorithms trained with historical price data and a significant number of calculated metrics. Tuned to achieve the highest possible repeatable accuracy while preserving high predictive power, it incorporates patterns and trend behavior through the use of machine learning algorithms.